Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

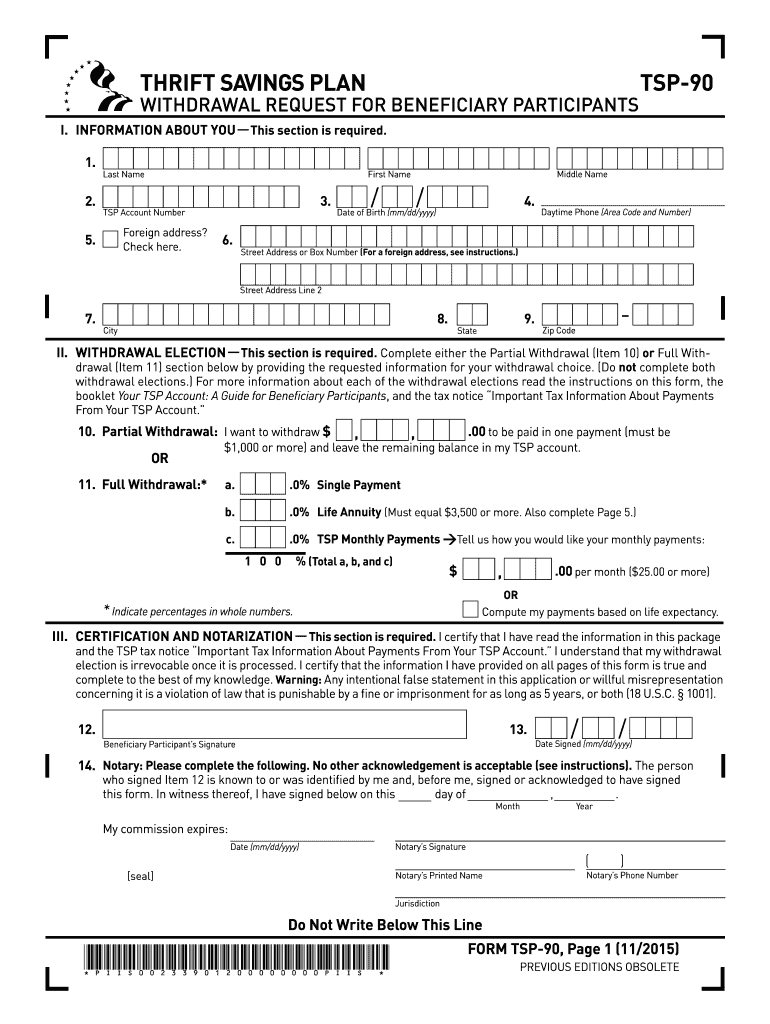

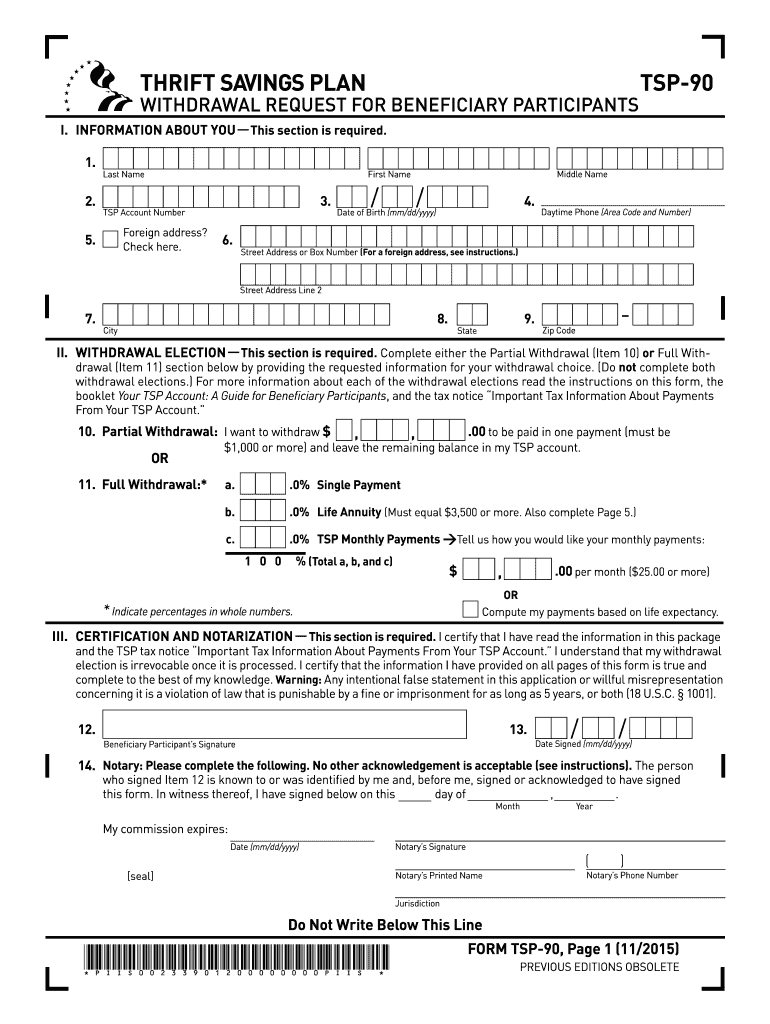

The TSP-90 form is a form used by the Thrift Savings Plan (TSP) of the Federal Retirement Thrift Investment Board (FRTIB). It is used to apply for a one-time in-service withdrawal from the TSP. The form includes information such as the type of withdrawal requested, the amount, the purpose of the withdrawal, and the TSP account holder's financial situation.

When is the deadline to file tsp 90 form in 2023?

The deadline to file TSP-90 (Thrift Savings Plan Election Form) for 2023 has not yet been announced. In general, the deadline falls during the last quarter of the year.

Who is required to file tsp 90 form?

The TSP-90 form is required to be filed by individuals who are eligible to make catch-up contributions to their Thrift Savings Plan (TSP) account. Catch-up contributions are additional contributions that individuals aged 50 and older can make to their TSP accounts on top of the regular employee contributions. The TSP-90 form is used to designate the amount of catch-up contributions an individual wants to make.

How to fill out tsp 90 form?

To fill out TSP-90 form, follow the steps below:

1. Obtain the form: Download TSP-90 form from the official website of the Thrift Savings Plan (TSP) or request a copy from your employer or human resources department.

2. Personal Information: Provide your personal details on the form. This includes your name, Social Security number, TSP account number, mailing address, and contact information.

3. Spousal Information (if applicable): If you are married and want to designate your spouse as the beneficiary of your TSP account, include his/her name, Social Security number, and relationship to you in this section.

4. Primary Beneficiary Information: Designate primary beneficiaries for your TSP account by including their names, Social Security numbers, relationship to you, and the percentage of the account you want to allocate to each beneficiary. If you want to allocate 100% to one beneficiary, write "100%" next to their name.

5. Contingent Beneficiary Information: Similar to the primary beneficiary section, provide details for any contingent beneficiaries. These are individuals who will receive your TSP account if all the primary beneficiaries predecease you. Include their names, Social Security numbers, relationship to you, and the percentage of the account you want to allocate to each.

6. Signature and Date: Sign and date the form at the designated places.

7. Witness Certification: If you are designating someone other than your spouse as the primary beneficiary and you live in a community or marital property state (AZ, CA, ID, LA, NV, NM, TX, WA, or WI), you must get your spouse's consent, who should sign and date the "Consent of Spouse" section.

8. Employer Certification: If you are completing the TSP-90 form as an employee, your employer must certify it. Submit the form to your employer or human resources department for their signature and date.

9. Submit the Form: After completion, make a copy of the filled form for your records. Submit the original form to the TSP for processing. The address to mail the form is provided on the last page of the form.

Always consult the instructions provided with the form, as they may contain additional details and requirements specific to your situation.

What is the purpose of tsp 90 form?

The TSP-90 form, also known as the Loan Application, is used by participants in the Thrift Savings Plan (TSP) to apply for a loan from their TSP account. The TSP is a retirement savings plan for federal employees, which allows them to contribute a portion of their income to a tax-advantaged investment account. The purpose of the TSP-90 form is to formally request a loan against the participant's TSP account balance, which can then be used for various purposes such as paying for education, buying a home, or covering financial emergencies. The form includes information about the loan amount, repayment terms, and other necessary details.

What information must be reported on tsp 90 form?

The TSP-90 form, officially known as the Transfer-In Form, is used by the Thrift Savings Plan (TSP) participants to transfer funds from another eligible retirement plan into their TSP account. The following information must be reported on the TSP-90 form:

1. Participant Information: This includes the participant's full name, Social Security Number (SSN), mailing address, and contact details.

2. Current Plan Information: The name of the current plan from which the funds are being transferred, the plan administrator's name and contact information, and the participant's plan account number.

3. Amount to be Transferred: The specific dollar amount or percentage of funds to be transferred from the current plan to the TSP account.

4. Type of Transfer: Indication of whether the transfer is a rollover from a qualified retirement plan, a direct transfer from an IRA, or a Roth conversion.

5. Certification and Signature: The participant must certify that the information provided is accurate and sign the form.

It is essential to consult with a financial advisor or the TSP administrator to ensure that the correct information is reported on the TSP-90 form for a smooth and accurate transfer process.

What is the penalty for the late filing of tsp 90 form?

The specific penalty for the late filing of a TSP-90 form (Thrift Savings Plan Form 90) may vary depending on the rules and policies of the individual's employer or the TSP administrator. Generally, the TSP-90 form is used to transfer money from a TSP account to an IRA (Individual Retirement Account) or another eligible retirement plan.

If a TSP-90 form is filed after the required deadline, the TSP administrator may reject the transfer request, leading to delays in withdrawing or transferring the funds. Additionally, there may be administrative fees or penalties associated with the late filing, which can vary depending on the specific circumstances and rules of the TSP plan.

It is important to reach out to the TSP administrator or employer for exact information on the penalties or consequences for the late filing of a TSP-90 form. They will be able to provide accurate and detailed information based on the specific plan rules.

How can I modify tsp 90 form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tsp 95 form pdf. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send tsp 99 form example for eSignature?

When your pdf blank tsp 99 form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in tsp form 90 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your tsp 90 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.